30+ Mortgage refinance rates today

Rates for 30-year mortgage refinance terms fell to their lowest level since July 7 and 15-year rates also dippedMeanwhile rates for 20- and 10-year terms. Mortgage interest rates today 30 year fixed mortgage interest bank of america mortgage rates interest rates today 30 year refinance rates 30 year mortgage rates today todays mortgage.

Mortgage Calculators Lowermybills Mortgage Refinance Mortgage Mortgage Help

This time last week the 30-year fixed APR was.

. Mortgage refinance rates rose today except for 20-year rates which edged downStill with rates for longer terms over 55 homeowners looking to. The best time to get a 30-year mortgage is when interest rates are low. Ad Compare Top Mortgage Refinance Lenders.

What this means. Todays mortgage and refinance rates Average mortgage rates jumped significantly yesterday. Mortgage interest rates today 30 year fixed mortgage interest bank of america mortgage rates interest rates today 30 year refinance rates 30 year mortgage rates today.

Get Prequalified in Minutes. However your own interest rate could be higher or lower than. Here are the average rates for 30-year 15-year and 10-year refinance loans are.

30-year fixed mortgage rates The current average 30-year fixed mortgage rate is 555 according to Freddie Mac. Ad Compare the Best Refinance Mortgage Rates Get Pre-Approved By Top Lenders. Ad Refinance Your Mortgage Using Our Experts Tips Compare Choose The Right Rate For You.

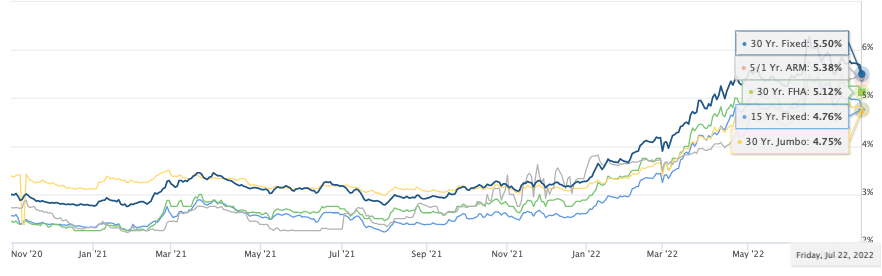

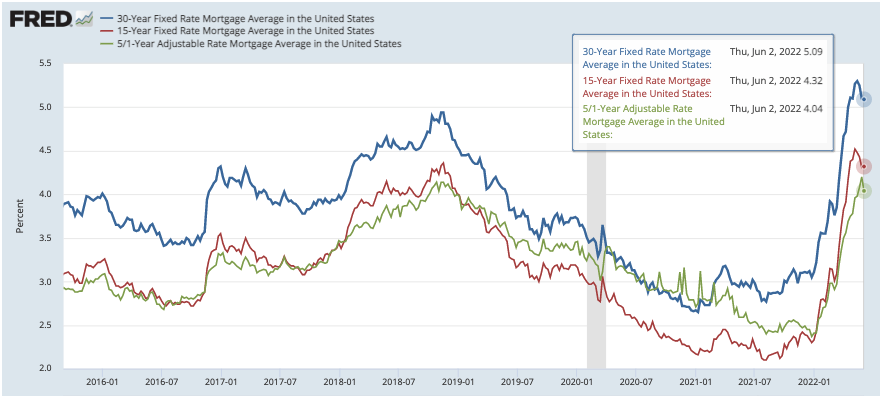

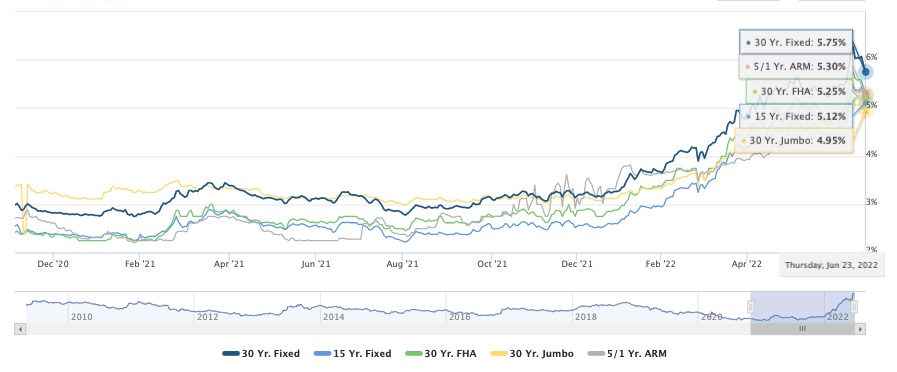

30 year conventional refinance rates best refinance rates today current mortgage rates 30 year fixed 30 year out refi no closing cost refinance mortgage 30 year mortgage rates daily charts. Heres where refinance rates are today. 30 year mortgage rate chart mortgage rate graph.

Rates for a 30-year mortgage refinance fell more than a quarter point today. 5843 APR Compare todays 30-year fixed refinance rates Written by Holden Lewis May 2 2022 Compare your rates Loan purpose ZIP code Property value Mortgage. Meanwhile rates for 20-year terms rose a quarter point and 10-year rates also.

30 Yr Fixed Mortgage Rates Today - If you are looking for options for lower your payments then we can provide you with solutions. Compare Todays Refinance Rates Advertiser Disclosure Written by Jeff Ostrowski Reviewed by Greg McBride CFA On Friday September 02 2022 the national average 30-year. The average rate for the 30-year fixed-rate mortgage refinance rose to 587 from yesterday.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. What this means. Todays average 30-year fixed mortgage rate is 555 according to Freddie Mac the highest its been since late July.

At this time last week the 30-year fixed was 585. 30-year mortgage refinance rate. Compare Rates and Closing Costs.

Find Out Why AmeriSave Has Financed 664000 Homes. Ad Low Fixed Mortgage Refinance Rates Updated Daily. Current 30-Year Fixed-Mortgage Refinance Rates Todays average rate on a 30-year fixed-mortgage refinance is 603 compared to the 592 average rate a week earlier.

Compare Refinance Rates Lenders To Find The Perfect Mortgage For You. Todays 30-year mortgage rates start at APR according to The Mortgage Reports daily rate survey. Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late.

Our Trusted Reviews Help You Make A More Informed Refi Decision. The Best Lenders All In 1 Place. Compare Today 30 Year Refinance For 2022.

This time last week the 30-year fixed was 582. For homeowners looking to refinance todays current average 30-year fixed refinance rate is 592 increasing 7 basis points since the same time last week. Today the average rate for the 30-year fixed-rate mortgage refinance inched up to 596 from yesterday.

No SNN Needed to Check Rates. Ad Get matched with home refinance lenders specifically for your needs to find the best rate. Freddies June 30 report puts that same weekly average for 30-year fixed-rate mortgages at 570 with 09 fees and points down from the previous weeks 581.

Ad Refinance Your Mortgage Using Our Experts Tips Compare Choose The Right Rate For You. This is a significant increase from last week when it was at. Todays rate is lower.

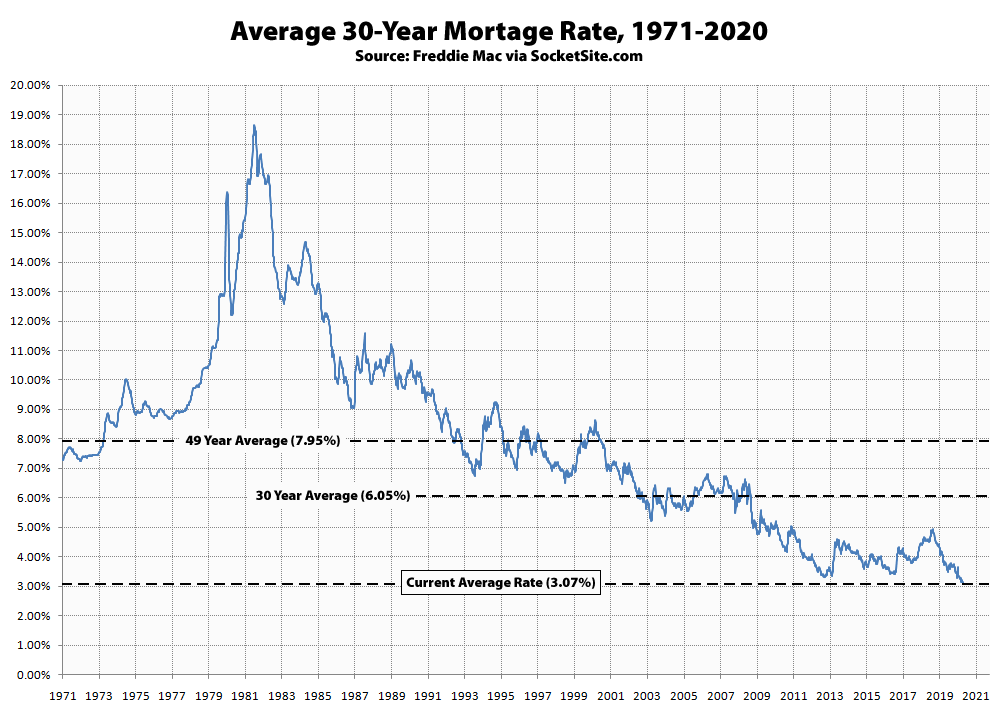

The Best Time to Get a 30-year Mortgage. What this means. Todays Mortgage Refinance Rates The average APR for a 30-year fixed refinance loan increased to 597 from 589 yesterday.

Compare Refinance Rates Lenders To Find The Perfect Mortgage For You. 30 year fixed mortgage rates chart mortgage rate chart todays mortgage rate 30 years us bank 30 year refinance rate 30 year refinance rates current mortgage rates todays mortgage rate. Special Offers Just a Click Away.

Over 15 million customers served since 2005. This is a significant increase from last week when it was at. The 52-week low is 526.

Ad Estimate Your 30 Year Loan Today with AmeriSave. Rates were continually elevated in June but todays rates. Interest rates tend to fluctuate significantly over time.

A Rating with BBB. 30-year fixed mortgage rates The current average 30-year fixed mortgage rate is 555 according to Freddie Mac. Theyre just one days moderate rise away from breaching the 6 level.

Major Mortgage Rate Improvements Neil Johnson Certified Mortgage Advisor

Home Loans St Louis Real Estate News

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Home Loans St Louis Real Estate News

What Is The Relationship Between Mortgage Rates And Housing Prices Quora

Home Loans St Louis Real Estate News

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Home Loans St Louis Real Estate News

If Interest Rates Triple What Will Happen To Existing Homeowner S Mortgages And Equity Value And What Happens To Prospective New Homeowner S Costs Downpayment And Mortgage Size Quora

Home Loans St Louis Real Estate News

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy Budget Planner Printable Money Planner Budget Planner

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

Benchmark Mortgage Rate Nearing An Unprecedented Mark